1031 tax deferred exchange meaning

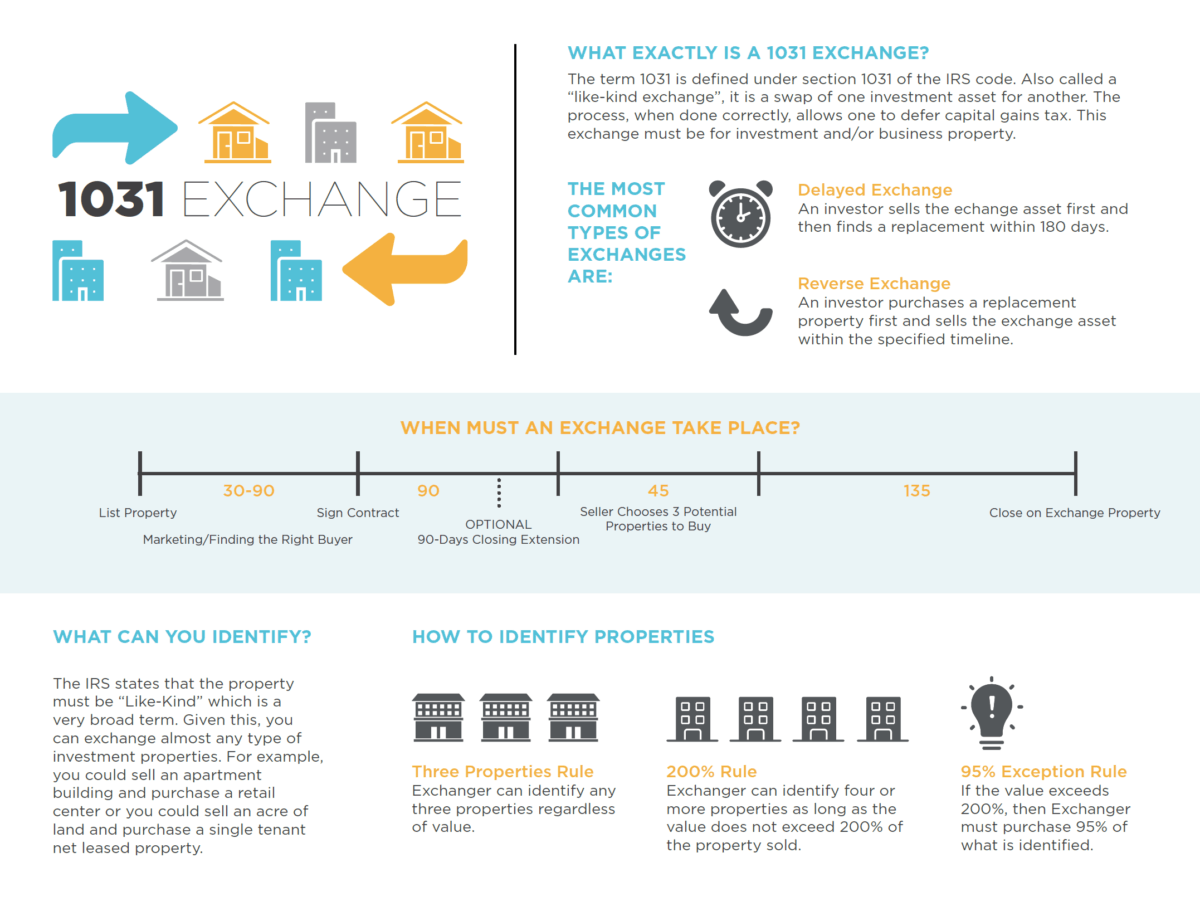

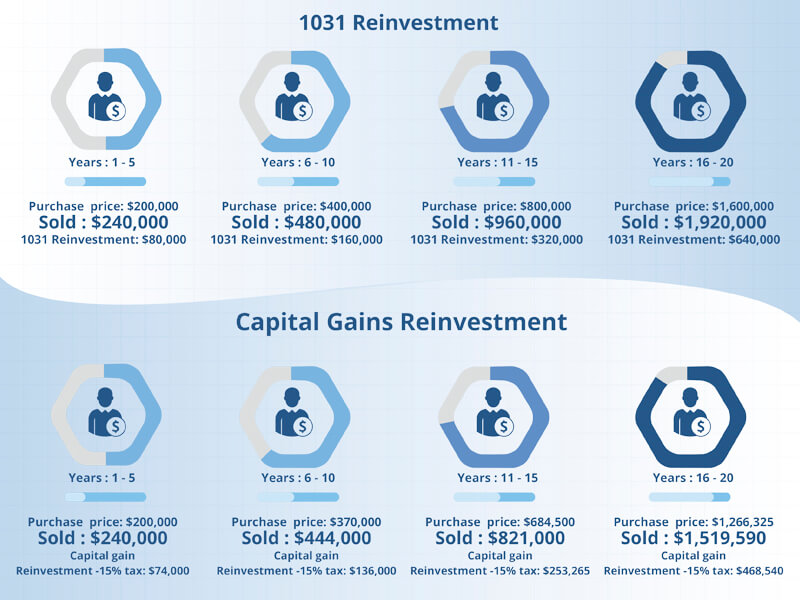

The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. Tax code defines a 1031 exchange as a like-kind exchange of one investment property for another in which capital gains tax liability is deferred.

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

What Is a 1031 Exchange.

. Ad Request Information On Unique 1031 REIT Exchange Programs. If you own investment property and are thinking about selling it and buying another property you should know about the 1031 tax-deferred exchange. Ad Request Information On Unique 1031 REIT Exchange Programs.

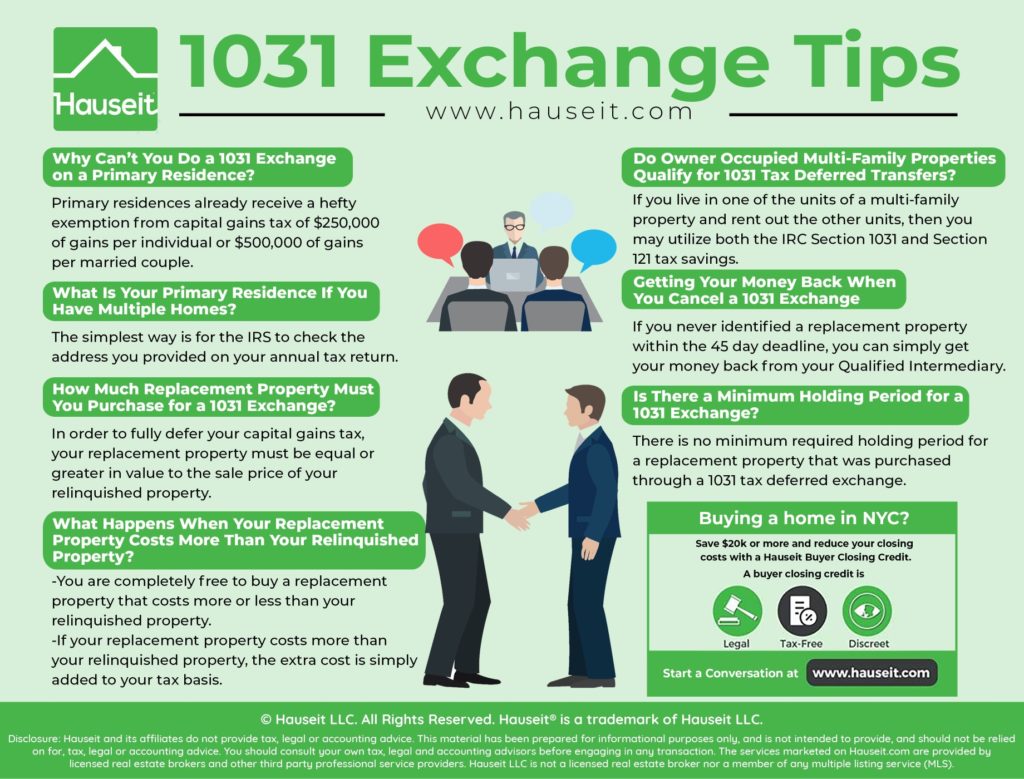

You can do a 1031 exchange into a REIT. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. 1031 Tax-Deferred Exchange Definition For real estate investors 1031 exchanges create an opportunity for investors to move from one property to another and provide tax benefits for.

The termwhich gets its name from Internal. The 1031 Exchange allows you to sell one or more appreciated rental or. Under Section 1031 of the United States Internal Revenue Code 26 USC.

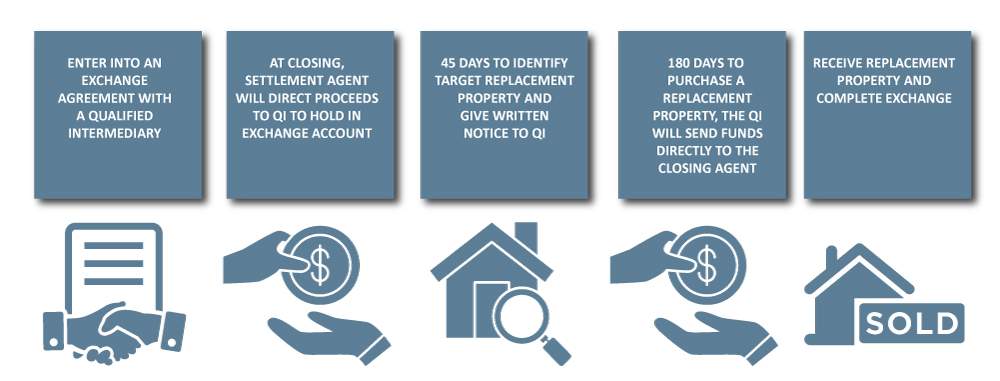

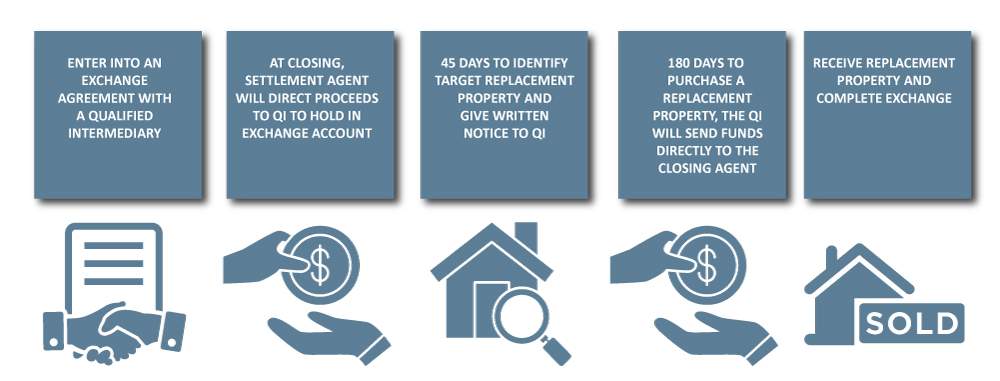

A 1031 Exchange also commonly called a Like-Kind aka Starker or Deferred Exchange refers to Section 1031 of the Internal Revenue Code that provides for the tax-deferred. Learn more about REITs for like kind exchanges. The deferred 1031 exchange gives you time by allowing you to sell your first property to an intermediary who then buys the property on the other end of the exchange at a later date.

A tax deferred exchange is a method by which a seller of property held as an investment or productive use in trade or business may defer paying tax on the gain by exchanging for other. Basically a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished properties for one or more like-kind replacement properties.

A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while. You can do a 1031 exchange into a REIT. 1031 Exchanges are complex tax planning and wealth building strategies.

Section 1031 is a provision of the Internal Revenue Code IRC that allows a business or the owners of investment property to defer federal taxes on some exchanges of. 1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange. Those taxes could run as high as 15.

What Is A 1031 Tax Deferred Exchange. Learn more about REITs for like kind exchanges. Section 1031 of the US.

The most common kind of 1031 exchange is a forward or delayed exchange using a Qualified A person acting to facilitate an exchange under section 1031 and the. This is a procedure that allows the owner. A 1031 Exchange a name derived from Section 1031 of the Internal Revenue Code is a real estate investing tool that allows investors to defer capital gains tax which is.

Top 1031 Exchange Real Estate Strategy Tips For 2022 Nnndigitalnomad Com

Definitions And Rules Of A Deferred 1031 Exchange Republic Title

What Is A 1031 Exchange Properties Paradise Blog

1031 Exchange What Is It And How Does It Work Plum Lending

1031 Tax Deferred Exchange Explained Ligris

Are You Eligible For A 1031 Exchange

6 Steps To Understanding 1031 Exchange Rules Stessa

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

1031 Exchange Faqs 1031 Exchange Questions Answered

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

Delayed Exchange 1031 Tax Deferred Exchange Ipx1031

1031 Exchange Explained What Is A 1031 Exchange

Irc 1031 Exchange 2021 Https Www Serightesc Com

1031 Exchange The Basics Take Me Home Bend The Source Weekly Bend Oregon

1031 Exchange Rules Tax Deferred Exchange Manhattan Miami

What Is A 1031 Exchange Asset Preservation Inc

How To Do A 1031 Exchange In Nyc Hauseit New York City

1031 Exchange What Is A 1031 Exchange Mark D Mchale Associates